Mish's Global Economic Trend Analysis |

- Flight Paths Over Turkey Analyzed; Obama Defends Turkey; Choose Your Friends and Enemies Wisely; Merkel Madness

- Richmond Fed Region Negative Again; Inventories Suggest Outright Disaster on Horizon

- Turkey Shoots Down Russian Plane; Two Seconds; New Cold War; Circular Absurdity

- Swiss Bank Hits Customers With Negative Interest Rates; Crazy? What About Velocity?

| Posted: 24 Nov 2015 02:39 PM PST In the wake of Turkey shooting down a Russian aircraft over Syria, the immediate impact will be to make negotiations on the removal of Assad all the more difficult. First let's analyze the flight path of the downed aircraft courtesy of Stratfor. Map of Flight Path of Downed Russian Aircraft  Deadly Few Seconds The short distances involved and the speed at which fighter jets fly does support the view made by a US official: "They were in Turkish airspace only 2 to 3 seconds". Obama Defends Turkey Voice of America reports Turkey Has Right to Defend Its Territory, Airspace. President Barack Obama said the downing of a Russian fighter jet along the Syrian-Turkish border Tuesday is evidence of an "ongoing problem" with Russia's military operations in Syria, and that Turkey had a "right to defend its territory and its airspace."Moderate Al Qaeda Yet Again There's Obama once again with more bullsheet about "moderate" Al Qaeda rebels. Nonetheless, it does appear Russia violated Turkey's airspace. Everyone is supposed to be on the same side here, but it's all a lie. Turkey buys oil from ISIS and that provides the funds for ISIS to buy weapons and maintain fighting. Both Turkey and the US would rather see Syrian president Assad fall than take out ISIS. I side with Putin who stated "This event goes beyond the framework of the regular fight against terrorism. today's loss is connected to a stab in the back by accomplices of the terrorists." Putin noted "a large amount of oil and oil products" entering Turkey from ISIS-held territory in Syria, provides the terrorist group with a "large money supply." Turkey the "Accomplices of the Terrorists" The Guardian analyzes Putin's viewpoint in Is Vladimir Putin right to label Turkey 'accomplices of terrorists'? The relationship hinted at by Russian leader after warplane was shot down is a complex one, and includes links between senior Isis figures and Turkish officials.Merkel Madness Turkey is guilty as charged. And yet, Angela Merkel wants to strike a deal with Turkey that would allow 75 million Turkish access to the Schengen border-free area from as soon as 2016. For details, please see Bargaining With the Devil: Germany Bribes Turkey With Aid Package, EU Sidelines Highly Critical Report on Turkey's Free Speech Record. Simply put, Angela Merkel is crazy. What to Expect Next Stratfor discusses the implications of this madness in What to Expect After the Downing of a Russian Fighter Jet. Turkey's downing of a Russian fighter jet in Syria has raised the stakes in an already crowded and complicated conflict. The Nov. 24 incident will also likely undermine efforts to find a solution to the country's protracted civil war.Choose Your Friends and Enemies Wisely Broadly speaking, this mess is precisely what one should expect under the idiotic doctrine "the enemy of my enemy is my friend". When everyone is everyone else's enemy, everyone becomes everyone else's friend under the practiced doctrine. Under such a doctrine, we are now friends with Al Qaeda terrorists even though we blew up Iraq on the mistaken premise Saddam Hussein was harboring them. Al Qaeda is now in our friends group because they seek to overthrow Assad. But ISIS also wants to overthrow Assad. US response in the region shows the US is more intent on taking out Assad, than taking out ISIS, even though Assad is no threat to anyone except those seeking to overthrow him. In turn, this proves the US can pick neither its friends nor its enemies wisely! But look on the bright side: It's good for those who seek perpetual war. For more on the sheer ridiculousness of US policy, please see New Cold War; Circular Absurdity. Mike "Mish" Shedlock |

| Richmond Fed Region Negative Again; Inventories Suggest Outright Disaster on Horizon Posted: 24 Nov 2015 12:05 PM PST Economists expected manufacturing activity in the Richmond Fed region would bounce into positive territory this month. The Bloomberg Econoday Consensus Estimate was +1 in a range of 0-4, but the reading of -3 came in below any economist's estimate. Early indications for the November factory sector are soft right now after Richmond Fed reports a much lower-than-expected minus 3 headline for its manufacturing index. Order data are very negative with new orders at minus 6, down from zero in October, and backlog orders at minus 16 for a 9-point deterioration. Shipments are also in contraction, at minus 2, with the workweek at minus 3. Employment, at zero, shows no monthly change but the declines for backlog orders and the workweek don't point to new demand for workers. Price data are subdued but do show some constructive upward pressure.Ahead of the release, Bloomberg had this to say: "Regional Fed surveys have been showing improvement in November and the same is expected for the Richmond Fed's manufacturing index." "Details in this report, as in other manufacturing surveys, did show life in October but there were points of weakness including lack of growth for new orders and extended contraction for backlog orders." Improvement? The New York region came in at -10.74 below the lowest Econoday guess of -8.50. The prior (October) release was -11.36, but -10.74 is not an improvement, it's a decline at a lesser rate. For more details please see Empire State Manufacturing Negative Fourth Month, Work Week Lowest Since Mid-2011. There was an improvement in the Philly Fed region, to +1.9 (See Philly Fed Slightly Positive After Two Months of Contraction) but I labeled that "noise" given the new orders and shipment components were negative and the workweek collapsed to -16.2 No Signs of Life Diving into the Richmond Fed Report, we see shipments, backlog of orders, and the average workweek all negative for the third month consecutive. New orders were down two of the last three months, and flat the third.  Check out those inventories! Manufacturers are not only stockpiling raw materials, they have stockpiled finished goods with declining orders, hoping sales will pick up. Outright Disaster on Horizon Looking ahead, growth in inventories vs. declining shipments and new orders does not bode well for employment or the workweek. In fact, inventories suggest an outright disaster is on the horizon. But hey, the six-month look ahead numbers look great.  Absurd Expectations Unfortunately, history shows those expectations are ridiculous. I analyzed the New York region look-ahead expectations and in 167 months, nearly 14 years of data, there were only five months (just under 3% of the time) in which current conditions exceeded projections made six months previous! For details, please see Tracking Manufacturing's Perpetual Overoptimism. For a followup, also see Persistent Overoptimism Three Ways: Truckers, Fed Economists, Manufacturers. Mike "Mish" Shedlock |

| Turkey Shoots Down Russian Plane; Two Seconds; New Cold War; Circular Absurdity Posted: 24 Nov 2015 10:42 AM PST Theater of Absurd The tangled web of friend-foe relationships in the Mideast has reached a new high point of circular absurdity.

Turkey Shoots Down Russian Plane The Financial Times reports Turkey Shoots Down Russian Fighter Jet on Syrian Border. Vladimir Putin has accused the Turkish government of providing financial and military support to Isis, in a furious response to the downing of a Russian fighter jet near the Syria-Turkey border.Where is Latakia? Latakia is the principal port city of Syria, as well as the capital of the Latakia Governorate. Thus, the Russian plane was over Syria, not Turkey when it was shot down. Two Seconds US officials told NBC "They were in Turkish airspace only 2 to 3 seconds, a matter of seconds" before the Turkish F-16s attacked. A U.S. military spokesperson in Baghdad backed the Turkish claim that they warned the Russian pilots they were in Turkish airspace before shooting down the aircraft.Rebels Down Russian Helicopter with US Supplied Anti-Tank Missile As part of the circular absurdity, ZeroHedge reports Syrian Rebels Destroy Russian Helicopter With US-Supplied Anti-Tank Missile. "It would be bad enough if the US were supplying TOWs to anyone in Syria. But this is Washington and Riyadh handing anti-tank missiles to forces that are firing them at the Iranians who are operating under cover of Russian airstrikes [to fight ISIS]. Just to drive that home: the US is waging war against Iran and Russia with but one degree of separation," commented ZeroHedge. Perpetual War Does anyone recall the US took out Saddam Hussein on the false premise, Iraq was harboring Al Qaeda? The statement Hussein was harboring Al Qaeda was not even true. But after the US took out Hussein and disbanded the Iraqi military, Al Qaeda and ISIS filled the military vacuum, fighting over Iraqi and Syrian territory. Al Qaeda terrorists became our friends, and ISIS a much in demand enemy. In the case for perpetual war, we need friends to sell weapons to, and enemies to fight. New Cold War Ian Shields, a professor of international relations at Anglia Ruskin University, warned the Turkish downing of the Russian warplane has the potential to spark a new Cold War. I suggest Cold Wars are so passé. No one wants one of those. Not enough people were killed, not enough weapons were sold, and not enough new enemies were made in the cold war to keep the war machine well oiled. Perpetual war is the solution, the bigger the better. Citizens United for WWIII Citizens United for WWIII, a think-tank led by US Senator John McCain and various presidential candidates of both parties, demands no less than a global hot war, preferably nuclear, including Russia and China. In case you are wondering, I made up the name Citizens United for WWIII. Unfortunately, the idea is correct, even if the think-tank name does not exist. Mike "Mish" Shedlock |

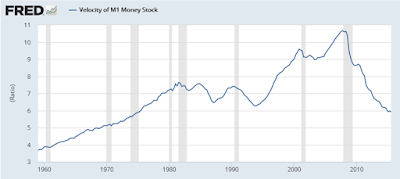

| Swiss Bank Hits Customers With Negative Interest Rates; Crazy? What About Velocity? Posted: 24 Nov 2015 02:25 AM PST Alternative Bank Schweiz (ABS), a small bank in Switzerland broke the negative interest rate on deposits barrier, CHARGING customers to take their money. (emphasis in caps from the article). The Alternative Bank Schweiz wrote to customers telling them they would face a -0.125 per cent rate on their money from 2016 – and a -0.75 per cent rate on deposits above 100,000 Swiss francs.Less Than Zero Bloomberg offers a "quick take" on Less Than Zero. Imagine a bank that pays negative interest. Depositors are actually charged to keep their money in an account. Crazy as it sounds, several of Europe's central banks have cut key interest rates below zero and kept them there for more than a year. For some, it's a bid to reinvigorate an economy with other options exhausted. Others want to push foreigners to move their money somewhere else. Either way, it's an unorthodox choice that has distorted financial markets and triggered warnings that the strategy could backfire. If negative interest rates work, however, they may mark the start of a new era for the world's central banks.Economic Distortions That's actually a balanced synopsis by Bloomberg as far as it went. But unlike Europe, the US has large money market funds that would be destroyed by negative rates. Banks may be able to hold out for a while by raising other fees, but money market funds would immediately be in trouble. Customers would withdraw money, put it into banks charging the lowest fees, stuff cash under the mattress, or open safe deposit boxes. If rates get negative enough, there would be a run on the banks, but a run on money market funds would likely happen first. Someone Has to Hold the Cash The central bank thesis is to get people to spend the money. But note the absurdity. Someone must hold every dollar printed at all times. If you buy a candy bar and eat it, or a coat and wear it, the store that sold those items to you has the money. Mathematically, someone at all times must hold all the money. What About Velocity? Reader "Vince" has been bugging me to write about the velocity of money. Velocity purportedly measures the speed at which money circulates in the economy. I have commented before on the absurdity of the velocity thesis, but this seems like a good time for a rehash. Velocity = Value of transactions / supply of money The value of transactions = price * transactions = GDP. Thus, velocity is nothing more than GDP divided by money supply. Here is the equation, two ways. V = PT / M V = GDP / M Right now, velocity is falling simply because money supply is increasing faster than GDP. But what constitutes money supply? M1, M2, MZM, base money, and true money supply all yield different measures of velocity. M2 Velocity  M1 Velocity  MZM Velocity  TMS Velocity  So is velocity 1.7, 5.9, 1.5, 1.3 or something else? If we rearrange the equation, GDP / Velocity = M. Supposedly we know GDP but what do we plug into the equation for velocity to derive M? Can one independently measure velocity? The answer to that question is a resounding no. Since GDP = PT, GDP can rise if prices rise and GDP can go up if transactions go up. GDP can rise if transactions decline, provided prices rise enough. And GDP can rise if prices decline, provided transactions rise enough.

Conclusions

Curiously, economists are concerned about "falling velocity" as if it means something other than the central banks are printing money that sits as excess reserves. Inquiring minds may also be interested in Frank Shostak's 2002 article Is Velocity Like Magic? Much of my understanding of velocity comes from that article. Shostak used the phrase "Velocity has no life of its own." On this Murray Rothbard wrote "It is absurd to dignify any quantity with a place in an equation unless it can be defined independently of the other terms in the equation." Mario Draghi on Velocity On November 20, Draghi Pledged to 'Do What We Must' to Boost Sluggish Inflation. Mario Draghi has dropped his clearest hint yet that the European Central Bank is about to inject more monetary stimulus into the eurozone economy, brushing aside staunch opposition from Germany's powerful Bundesbank.Question for Draghi I laughed out loud at that last line. If QE increases velocity, then why is velocity declining in the US, in Europe, and in Japan? By the way, bank reserves do not circulate. Reserves are deposits that are not lent out. One can even argue that money does not really circulate per se, as it has to be held at all times by someone. Negative Interest Rates Crazy? Let's return to this statement by Bloomberg: "Crazy as it sounds, several of Europe's central banks have cut key interest rates below zero and kept them there for more than a year". Yes, negative interest rates are crazy. Link if video does not play: Crazy - Patsy Cline. Desperation and Hubris

It's crazy to keep trying things that cannot possibly work, over and over again. Mike "Mish" Shedlock |

| You are subscribed to email updates from Mish's Global Economic Trend Analysis. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment