Mish's Global Economic Trend Analysis |

- Another Round-Trip in Crude; Search for Inflation; Another Bout of Asset Deflation Hell Coming Up

- Housing Regulator Wants to Throw the Drowning Poor an Anchor; Mish Alternative Proposal

- Plotting the Fed's Baby Step 1/8 Point Hikes; Yellen vs. Greenspan "Measured Pace"

| Another Round-Trip in Crude; Search for Inflation; Another Bout of Asset Deflation Hell Coming Up Posted: 19 Aug 2015 02:14 PM PDT Crude prices are back to where they were in 2004. Before that, crude previously topped near $41 in September of 1990!  Recall the hyperinflation talk in June of 2008 when crude hit $147? Cries of massive price inflation again became talk of the town when crude rebounded to a secondary high of $115 in April of 2011. It's been yet another round trip in crude. CPI Barely Positive Today the BLS reported CPI for All Items Rises 0.1% in July as Shelter Index Increases. The Bloomberg Consensus was for a 0.2% rise. Inflation wasn't brewing in July and with oil prices moving lower, inflation may not be showing much pressure in August either. The consumer price index rose only 0.1 percent in July as did the core, both under expectations. Year-on-year rates show slightly more pressure. Overall inflation is up 0.2 percent, which is very low but up from 0.1 percent in the prior month and the second positive reading of the year. The core is steady at plus 1.8 percent which is just under the Fed's 2 percent target.CPI Percent Change From Year Ago (All Items)  CPI Percent Change From Year Ago (All Items Less Energy) If we strip out the effect of energy, the chart looks like this.  Search for Inflation Those who claim inflation has been tame, don't know where to look. Here's where to find it.

Inflation has been soaring since March 2009 with the revival of the junk bond market. Fool's Mission Central bankers, led by the Fed have strenuously attempted to hit preposterous 2% inflation targets to no avail. The result was massive bubbles in equities and corporate bonds (especially junk bonds), globally. Few see those bubbles because they have not yet popped. But they will, and signs are picking up the time is now. Another Bout of Asset Deflation Hell Coming Up In a foolish endeavor to spur price inflation, central bankers have guaranteed another round of destructive asset deflation. Credit deflation will follow because loans made on the assumption of forever rising asset prices will once again become impaired. For the real scoop on the idiocy of 2% price inflation targets, please see Historical Perspective on CPI Deflations: How Damaging are They? Mike "Mish" Shedlock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Housing Regulator Wants to Throw the Drowning Poor an Anchor; Mish Alternative Proposal Posted: 19 Aug 2015 11:13 AM PDT Now that home prices have recovered from the Great Financial Crisis to the point of being way overvalued again in many areas, a Housing Regulator Targets More Support for Poor Borrowers. The regulator for U.S. housing finance giants Fannie Mae and Freddie Mac told the two firms on Wednesday to provide more support to low-income Americans taking out mortgages and refinancing home loans.Throw the Poor an Anchor The increases are small. But they are also symbolic of the same attitudes that got us in trouble before. It would have made far more sense to widen availability in 2009 when homes were more affordable. Now after prices have recovered, regulators again want to "do something" to make housing more affordable. But the more support they give, the more people are encouraged to buy beyond their means, and the more prices rise. We don't need regulators of this nature. Nor do we need a Fed price-fixing interest rates. Both contributed to the housing boom-bust and both are back at it again. No one learned a damn thing. Mish Proposal

Mike "Mish" Shedlock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

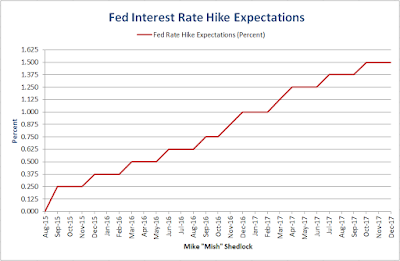

| Plotting the Fed's Baby Step 1/8 Point Hikes; Yellen vs. Greenspan "Measured Pace" Posted: 18 Aug 2015 11:58 PM PDT The market still believes the Fed will hike rates in September or October. The CME's FedWatch Sees it like this.  That table is based on Fed Fund Futures and option bets. I highly doubt the Fed will think about a half-point hike no matter how strong the economic data between now and the September 16-17 meeting. Fed Funds Futures expire on the last day of the month but settle at the average rate for 30 days prior. Using Fed Funds Futures (not options) from August 18, I generated the chart and table below. Implied Fed Funds Rate 2015-08-18  click on any chart for sharper image Comments

Let's assume the Fed actually does get a hike off in September if for no other reason than the market expects such a hike. Based on Fed Fund Futures and FOMC Meeting Dates, and taking into account 30-day averages, the table of future rate hikes looks something like this. Rate Hike Dates and Amounts

Fed Funds Futures strongly suggest the Fed will move to 1/8 point hikes, down from current moves of 1/4 point or more, and widely spaced at that. Taking into account FOMC meeting dates, I created the following chart. Fed Interest Rate Hikes and Dates (Implied from Futures)  Yellen vs. Greenspan

Measured Pace Revisited Inquiring minds may wish to investigate my November 6, 2007 commentary on Greenspan's "measured pace", well ahead of the crisis: Greenspan on Housing, Central Bank, Gold. Even at the above half-pace, half-measure set of market expectations, I suggest we will not see many of those hikes. Instead, I propose the Fed delayed hikes so long, that an interim recession will gum up the works leaving the Fed no room to cut. My recession warning still stands. Mike "Mish" Shedlock |

| You are subscribed to email updates from Mish's Global Economic Trend Analysis To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment