Mish's Global Economic Trend Analysis |

- Is There a US$ Shortage? Will it Sink the Global Economy? Again?

- Driverless Cars and Trucks: Who Wants One? How Many Jobs Will Vanish?

- Wholesale Trade: Sales Down, Inventories Up; GDP Estimate Revised Lower Again; Sticking With Recession Call

- From ZIRP to NIRP: Virtues of Germany vs. the Vices of Greece; What About "Speece" and Gold?

| Is There a US$ Shortage? Will it Sink the Global Economy? Again? Posted: 10 Mar 2015 10:59 PM PDT Reader Patricia is wondering about a recent ZeroHedge article, The Global Dollar Funding Shortage Is Back With A Vengeance And "This Time It's Different". The last time the world was sliding into a US dollar shortage as rapidly as it is right now, was following the collapse of Lehman Brothers in 2008. The response by the Fed: the issuance of an unprecedented amount of FX liquidity lines in the form of swaps to foreign Central Banks. The "swapped" amount went from practically zero to a peak of $582 billion on December 10, 2008.Another Margin Call? Reader Patricia writes... I have believed for quite some time that the catalyst for the 2008 crash was the action of European Commercial banks. They got themselves into huge trouble by creating a huge mismatch in their asset and loan funding requirements. That led to a global US dollar shortage which the Fed mitigated using their special swap facility. So the Fed bailed out the rest of the would at the expense of US citizens.Result or Cause? Here was my answer to Patricia ... "I do not believe there is a dollar shortage or even a synthetic dollar shortage. More importantly, a dollar shortage certainly did not cause the crash in 2008. Excess debt and speculation caused the crisis in 2008. Any alleged or apparent dollar shortage was a result, not a cause of the crash." Acting Man Chimes In I replied to Patricia and copied Pater Tenebrarum at the Acting Man blog. He replied in much more detail than I did. Hello Patricia,Demand for Dollars It's amusing to discuss currency shortages given all the central banks are or have been flooding the markets with currency in an inane attempt to cure a debt problem by forcing more debt into the system. I discussed this on Monday in Draghi's Goal: Higher inflation and Negative Yields; ECB's Asset Purchases to Outstrip Supply 3-1; Is There a Catch? That interest rates are negative in Germany for every duration from one month through six years (only two basis points from seven) speaks for itself. There is no demand for loans relative to supply of euros from the ECB. All Draghi has done is shove more risk down the throats of various national central banks. The result is banks in Spain are stuffed with Spanish bonds; Banks in Germany are stuffed with German bonds; Banks in Portugal are stuffed with Portuguese bonds. The ECB is taking on 20% of this risk of Draghi's 1.1 trillion bond buying spree. Countries have 80% of the risk. Bond traders front-ran the trade. They are all betting on increasingly negative yields. No one wants credit. Why is that? Reasons for Lack of Lending

There are no other possible reasons that would explain the setup we are in. It is not a matter of confidence as Draghi believes. QE Baton Given that Bernanke and Yellen somehow managed to pass the QE baton to Japan and the ECB, it is entirely possible the US dollar soars to unimaginable heights. Some might think we are already there. At some point however, this will reverse. And it may not take much to do it. Let's step back one more time with a simple question. Why is there an overwhelming belief in dollars? Three Reason for Belief in Dollars

Point number one is quite suspect. Yes, the Fed may very well get in a hike or two (or not). But if the Fed does not hike as much as expected, demand for dollars will likely sink quite rapidly. Also consider point number two. Not only is the US dollar rising, so are US stocks. This creates a huge demand for dollars and various carry trades. Right now, US stocks are a one-way and massively one-sided trade. Point number three is likely to stay that way. But, it is relative moves and directions of moves that matter. In effect, if point number one disappoints, so will point number three. Same as 2008 or Opposite?  The US dollar index is at roughly the same level as in 1998, also 1988 (not shown). The peak in 1985 was 164.72. The peak in 2001 was 121.21. Lehman Bankruptcy On September 15, 2008, Lehman filed for bankruptcy. The dollar bottom was in April of 2008, at 71.33. At that time, anti-US$ sentiment was massively in vogue. The Schiff's of the world were screaming hyperinflation. Today, US hyperinflationists are thoroughly discredited and in hiding. Today, nearly everyone loves dollars and hates gold. Dollar swaps that were not in place then, are in place now. All things considered, conditions are nearly the opposite of 2008. Swaps vs. Alphabet Soup The Fed did not save the world with swaps. Historian will surely debate Bernanke's policy moves for the next century. Bernanke did initiate a huge number of lending programs (cleverly dubbed "Alphabet Soup" by Bloomberg columnist Caroline Baum). Those lending programs eventually revived the corporate bond market in 2009. One of the programs was dollar swaps. It's debatable if that was the key program. If one wants to ignore all Bernanke's mistakes that led to the crisis, and give him credit for "Alphabet Soup", so be it. In fact that will be the nature of the future historical debate, and I doubt history will be so kind. Expect New Script First things first. Bernanke, followed by Yellen, then the Bank of Japan and then the ECB have all carried competitive QE madness so far that a currency crisis is now baked in the cake. No one see its because it will not be "obvious" until long after it happens, just as with the dot-com bust and the housing bubble. Finally, the next crisis is highly unlikely to follow the 2008 script, because the 2008 script is what central banks have prepared for. Central banks always strive to prevent the last crisis, never the next one. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Driverless Cars and Trucks: Who Wants One? How Many Jobs Will Vanish? Posted: 10 Mar 2015 03:36 PM PDT Comments on my blog soar every time I write about driverless vehicles. Such was the case again yesterday when I wrote Driverless Cars in 30 US cities; Death of Cars? Convenience vs. Cost; Comfortable Predictions. Like it or not, driverless vehicles are coming. And I expect people to embrace them even sooner than I said yesterday. One look at the Mercedes Benz F015 has me convinced.  Who wouldn't want that?  Heck, I like to drive and I would appreciate the chance to play cards or work on my computer instead of driving. Think this is years from the road? Think again. It is Cruising the Streets of San Francisco right now.  Zero Emissions - Range 684 Miles "The electric hybrid system has a total range of 1,100 kilometres, including around 200 kilometres of battery-powered driving and around 900 kilometres on the electricity from the fuel cell. This enables the F 015 Luxury in Motion to cover distances similar to those of a comparable diesel-engined car, but purely on electric power with zero local emissions." F015 Video Link if video does not play: F015 Video Windows? What looks like side windows, aren't. Rather, "Six displays are installed to this end all around, tastefully mounted in the instrument panel and the rear and side walls, making the interior of the F015 Luxury in Motion a digital living space. Passengers are able to interact intuitively with the connected vehicle by means of gestures or by touching the high-resolution screens."  Once again, I repeat technology is advancing at an amazing pace. These cars will be far safer than human driven cars. Luxury starts at the top end and works its way down. What is high-end now will be common-place in a few years. Taxis and buses will not have Mercedes-luxury. But as with autos, drivers will not be needed. In the cities, driverless cab companies will eliminate the need for drivers. Trucks may easily be first. The cost of truck drivers is huge, and the drivers have to stop to eat and sleep. Driverless Truck Hours vs. Current Regulations Driverless trucks will not need to stop except to fuel. In contrast, check out government safety regulations effective July 1, 2013. FMCSA's Hours-of-Service Rules

Drivers Not Needed

This will happen far faster than most think. And when it does happen, it will likely be en masse. This is the death of the paid driver industry. Everyone benefits but the paid driver. 3.5 Million Jobs Will Vanish All Trucking comments on the number of Truck Drivers in the USA. There are approximately 3.5 million professional truck drivers in the United States, according to estimates by the American Trucking Association. The total number of people employed in the industry, including those in positions that do not entail driving, exceeds 8.7 million. About one of every 15 workers in the country is employed in the trucking business, according to the ATA. These figures indicate that trucking is an exceptionally stable industry that is likely to continue generating jobs in the coming years.Trucking will be stable until it crashes hard and millions of jobs vanish overnight. Timeline is sometime in the next 5-6 years, and it could easily be less. Driverless cabs and Uber will eliminate another 250,000 drivers or so. If you are a paid driver, be prepared to lose your job. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

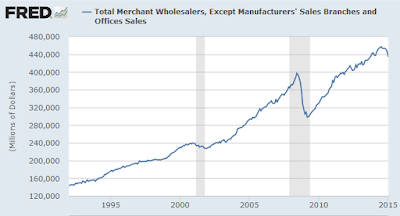

| Posted: 10 Mar 2015 10:25 AM PDT The US Commerce Department Monthly Wholesales Report for January 2015 shows sales are down while inventories continue to rise. Wholesale Trade Sales

Wholesale Trade Inventories

Inventory to Sales Ratio  click on chart for sharper image Seasonally Adjusted Sales  Seasonally Adjusted Sales Percent Change From Year Ago  Diving Into the GDP Report On January 31, I went Diving Into the GDP Report and noticed some ominous trends. Growth in fixed investment is falling rapidly. Equipment, industrial equipment, and transportation equipment are already in contraction.GDP Revised Lower Again Today I have been calling for lower and lower GDP estimates all year. And here we go again with the latest GDP Now Projection from the Atlanta Fed.  Recession Call On March 5, I reported Factory Orders Unexpectedly Decline 6th Month. The adjusted Fed GDP forecast is rapidly approaching the stall point of 1%. It does take into consideration today's trade numbers. But the US dollar continues its upward climb and much of the world is still slowing including our biggest trade partner, Canada. In the history of the wholesale trade series dating back to 1993 (first three charts above), the only time sales have gone negative year-over-year was when the economy was in recession. I am sticking with my recession call. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| From ZIRP to NIRP: Virtues of Germany vs. the Vices of Greece; What About "Speece" and Gold? Posted: 10 Mar 2015 12:18 AM PDT Virtues of Germany vs. the Vices of Greece At the heart of the constant bailout bickering in Europe is a fundamental, but seriously misguided notion that a battle is underway between the virtuous and fiscally responsible Germans and the irresponsible Greeks, Spaniards, and Portuguese. In this incorrect view, the Spaniards have begun to see the light, but the Greeks need a serious lesson in morality. If we step back and actually assign blame, we can find plenty of blame to go around. "Speece" (my term for the Southern eurozone deficit countries of Spain, Greece, Portugal etc.) made many mistakes, but so did Germany. It's logically impossible to believe "Speece" was a horrendously imprudent borrower, while simultaneously holding the view that Germany was a prudent lender. More importantly, neither imprudent borrowing nor imprudent lending is at the heart of the eurozone problem. Background Notes Some snips from this post are from an email from Michael Pettis at Global Source Partners. Pettis' email contained a 32 page PDF that I will attempt to condense down to a couple pages, while adding a few pages of my own on topics he missed or went over lightly. Except where noted, anything below in blockquotes is from Michael Pettis. Emphasis throughout is mine. In regards to comments from Pettis, he says "As my regular readers know, I generally refer to the two different groups of creditor and debtor countries as 'Germany' and 'Spain', the former for obvious reasons and the latter because I was born and grew up there, and it is the country I know best. Thus any comment from Pettis on "Spain" may mean "any eurozone debtor" and any comment on "Germany" may mean "any eurozone creditor". I occasionally use the term "Speece" in the same way. In context, sometimes Pettis says "Spain" and means "Spain". It's usually clear. Moral Battle Update On February 27, the German Bundestag approved Greece's bailout extension request, but acrimony remains high. For example, the Financial Times noted Germany's biggest selling newspaper Bild attacked the Bundestag's decision to extend the bailout, with a front page on headline "Bild readers say No – no more billions for Greece." In the Bundestag, Klaus-Peter Willsch, a CDU legislator and longstanding bailout critic, launched a personal attack on the Greek prime minister and finance minister. "Look at [Alexis] Tsipras, look at [Yanis] Varoufakis, would you buy a used car from them? If the answer is no, then vote no today," said Willsch. And during the intense negotiations between Greece and Germany ahead of this vote, the parliamentary caucus leader of German Chancellor Angela Merkel's Christian Democrats, Volker Kauder, told reporters "Germany bears no responsibility for what happened in Greece. The new prime minister must recognize that." No Responsibility? Does Kauder really believe Germany has "no" responsibility? Does finance minister Wolfgang Schäuble who has made similar-sounding statements believe that? Whether or not Kauder and Schäuble believe their statements, people hear them again and again. Over time, such statements become conventional wisdom. From Pettis ... Nationalist Dreams European nationalists have successfully convinced us, against all logic, that the European crisis is a conflict among nations, and not among economic sectors.Savings Rate Distortions From 2000-04 Spain ran stable current account deficits of roughly 3-4% of GDP, more or less double the average of the previous decade. Germany, after a decade of current account deficits of roughly 1% of GDP, began the century with slightly larger deficits, but this balanced to zero by 2002, after which Germany ran steady surpluses of 2% for the next two years.Push vs. Pull I think we can look at push vs. pull another way. To pull credit, one bids up the interest rate. To push credit, one pushes the interest rates down. From the push-pull interest rate point of view, the "blame Germany" crowd has the better argument. Arguments Against Debt Forgiveness Pettis provides a number of widely used arguments against debt forgiveness. The arguments boil down to a couple of primary beliefs. Most have heard one or both of the following.

Was there really a choice? Did Speece make these mistakes acting alone or because of "venality of its leaders". Pettis answers ... Blaming Nations Because German capital flows to Spain ensured that Spanish inflation exceeded German inflation, lending rates that may have been "reasonable" in Germany were extremely low in Spain, perhaps even negative in real terms. With German, Spanish, and other banks offering nearly unlimited amounts of extremely cheap credit to all takers in Spain, the fact that some of these borrowers were terribly irresponsible was not a Spanish "choice".Not really. Pettis explains ... "There is no such a decision-maker as 'Spain'. As long as a country has a large number of individuals, households, and business entities, it does not require uniform irresponsibility, or even majority irresponsibility, for the economy to misuse unlimited credit at excessively low interest rates. The experience of Germany after 1871 suggests that it is nearly impossible to prevent a massive capital inflow form destabilizing domestic markets."Pro-Cyclical Feedback Loops Spain could not stop these pro-cyclical feedback loops of massive proportion because Spain did not have control over its own interest rate policy or currency. Instead, the ECB had an interest rate policy best described in my opinion as "one size fits Germany". The bubble-blowing feedback loop fed on itself until it blew up. Who is really to blame for that? Target2 No discussion of eurozone problems would be complete without a discussion of Target2, an abomination created by the eurozone founders and one of the fundamental flaws of the euro. Target2 stands for Trans-European Automated Real-time Gross Settlement System. It is a reflection of capital flight from the "Club-Med" countries in Southern Europe (Greece, Spain, and Italy) to banks in Northern Europe. Pater Tenebrarum at the Acting Man blog provides this easy to understand example: "Spain imports German goods, but no Spanish goods or capital have been acquired by any private party in Germany in return. The only thing that has been 'acquired' is an IOU issued by the Spanish commercial bank to the Bank of Spain in return for funding the payment." Also, if people in "Speece" no longer trust their banks, they pull their deposits and park them elsewhere. Channel for Capital Flight PIMCO explains Target2 as a Channel for Capital Flight. The EU's loans to Greece, Ireland and Portugal are just the tip of the iceberg of a fledgling transfer system that is creeping into the eurozone via the back door. A far bigger and implicit subsidy is growing beneath the surface in the form of TARGET2.Target2 Imbalances  Chart courtesy of Euro Crisis Monitor. As of January 15, 2015, the Target2 numbers look like this, in billions of euros:

Key Target2 Numbers

The ECB treats all of these surpluses and deficits as if they were equal and as if they don't matter. Clearly they are not equal, and they do matter. Role of Attitudes It's not entirely true that attitudes played no role in this mess. Germans tend to view things quite differently because of their experience with hyperinflation in the 1920s. Today, socialists rule France, Greece, Spain and other countries. Greece has a history of defaults. To completely dismiss such items is wrong. But who bears responsibility? The Germans, the Greeks, the Spaniards? Speece? The answer is the eurozone founders and the eurozone aggregate members. Greece lied to get into the eurozone. But every country knew Greece lied. If they didn't, they should have. And if Germany knew Greece lied, who gets the bigger share of the blame? More fundamentally, the eurozone founders knew full well there were serious productivity differences, work rule differences, pension differences, etc., etc., between countries. The eurozone founders mistakenly assumed that all the countries would get together and solve these issues. Oops. That is damn near impossible now because rule changes require consent of every eurozone country. The more countries that are added, the more difficult it is to get rule changes. Currently a mass of rule changes are sorely needed on agricultural issues, work issues, pension issues, and literally dozens of issues. Any country can block reform. Gold Standard Of all the laughable analogies made about the euro, at the top of the list is the notion the euro acts likes the gold standard. One can find many writers making such claims. For example, please consider Actually, There Is A Gold Standard Today, And It's Causing An Economic Catastrophe. The post is fatally flawed, yet it does reflect conventional wisdom. Here is a short rebuttal: Only in the superficial sense, that countries cannot debase their currency in isolation, does the euro remotely resemble a gold standard. On a practical and far more important basis, Target2 and the common interest rate policy are the opposites of what would happen on a gold standard. Prior to Nixon closing the gold exchange window, countries running perpetual currency account deficits would see an outflow of gold they would eventually need to do something about. In the eurozone, the ECB set interest rate policy (primarily for the benefit of Germany) and Target2 said the deficits of Speece do not matter. Under a gold standard, no one would have lent his own hard-earned gold to Speece, without much higher interest rates and good collateral to secure the loan. This of course would have dampened appetite for borrowing. Simply put, the eurozone setup was the exact opposite of what would have happened under a gold standard. Still No Enforcement Mechanism, Anywhere Because there were no trade imbalance enforcement mechanisms, Speece imbalances grew until they blew up. And until they blew up, the IMF had nothing but praise for Spain! And every step of the way, the IMF underestimated the problems Greece faced. We are headed into the third Greek bailout, and the IMF remains clueless about Greece's ability to pay back "bailout" money. Worse yet, there still is no "enforcement" mechanism anywhere in the world, and the structure of the euro is such that imbalances in Europe are even harder to fix than elsewhere. ZIRP to NIRP In the US, we see chronic trade imbalances with China, Japan, and oil producers. We also see constant bickering as to whether or not to label China a "currency manipulator". Every country is manipulating currency now, one way or another. China does so with pegs, most countries manipulate via interest rate policy. The mad race to ZIRP has now gone to NIRP. Zero interest rate policy has morphed into negative interest rate policy in a global beggar-thy-neighbor scheme. EFSF and ESM - Short Term Stabilizing, Long Term Destabilizing The European Financial Stability System (EFSF), was created in 2010 as a "temporary" crisis resolution mechanism. The EFSF provided financial assistance to Ireland, Portugal and Greece. The ESM is supposedly a "permanent" crisis resolution mechanism. The ESM has provided loans to Spain and Cyprus. Risk is shared by all eurozone member states in proportion to their share in the paid-up capital of the European Central Bank. That risk sharing is in clear violation of Maastricht Treaty no-bailout provisions, but few care about rules in time of crisis. The problem with "risk sharing" is that every county is partially responsible for problems elsewhere. In short, Spain is partially responsible for Greece, and vice versa. This can lead to cascade effects if a country defaults on bailout obligation. Dr. Eric Dor, director of IESEG School of Management in Lille, has an update on exposure to Greek debt liabilities. The details are interesting.

The above table is from Exposure of European Countries to Greece by Dr. Eric Dor, IESEG School of Management. Note: The above table was produced at a different time than the Target2 balances that preceded it. There may be slight differences. Spain which is in its own ESM bailout agreement is supposedly liable for €32.744 of Greek exposure. How is that going to work, besides not? Some disagree (or more likely say they disagree because it suits their short-term needs), but these bailout agreements as structured are in clear violation of the Maastricht Treaty. At some point, this will come back to haunt those who dreamed up those schemes. Problem is Not Virtue vs. Vice Let's return to a statement Pettis made much earlier: To the extent that the European crisis is seen as a struggle between the prudent countries and the irresponsible countries, it is extremely unlikely that Europeans will be willing to pay the cost. Blame Assignment Hopefully it is now clear the problem is not virtue vs. vice, but something far more complex. With that in mind, the question of the day is "how do we assign blame for problems in Speece?" In rough order, I propose ....

Most have attitudes at the top. I have attitudes at the bottom. I suppose one could summarize points 1-5 simply as the "eurozone flaws" or the "euro" but each is worth discussing separately. Debt Dynamics Pettis says "Even if the question of who is to blame, Greece or Germany, were an important one, the answer would not change the debt dynamics." True enough. In the end, Greece will not pay back, what cannot be paid back. Indeed, two haircuts have already been taken. The bickering now is whether or not there will be another bailout, and still further haircuts. How do we know Greece cannot pay back the existing debt? The market tells us so. Ironically, by the time the market makes it clear there is a huge problem (yields soar for example), it's too late to do much of anything but assign costs. Said Pettis, "My friend Hans Humes, from Greylock Capital, has been involved in more sovereign debt restructurings than I can remember, and he once told me with weary disgust that while it is usually pretty easy to guess what the ultimate deal will look like within the first few days of negotiation, it still takes months or even years of squabbling and bitter arguing before getting there. We cannot forget however that each month of delay will be far more costly to Greece and her people than we might at first assume." Rise of Fringe Parties Curiously, one of the biggest finger-pointers in this mess now is Spain. The Financial Times talked about it in Spain Keeps Hawkish Eye on Greece as Southern Solidarity Crumbles. "In its fear of Podemos, the Spanish equivalent of Syriza, and its determination to be one of the 'virtuous' countries, it strikes me that Madrid is probably moving in the wrong direction economically. Ultimately, by tying itself even more tightly to the interests of the creditors, Rajoy and his associates are only making the electoral prospects for Podemos all the brighter," said Pettis. Solidarity Where? On Monday March 2, acrimony took another huge step forward as Greek premier Alexis Tsipras accused Spain and Portugal of sabotaging negotiations. "We found opposing us an axis of powers ... led by the governments of Spain and Portugal which, for obvious political reasons, attempted to lead the entire negotiations to the brink," Tsipras told party members on Saturday.Prime minister Rajoy responded "We are not responsible for the frustration generated by the radical Greek left that promised the Greeks something it couldn't deliver on." Spanish Prime Minsiter Mariano Rajoy is making a big mistake. Spain can use debt relief. And the citizens of Spain want debt relief. By taking a hard stance in favor of Berlin, Rajoy adds fuel to the rise of Podemos. Siding with Germany is the wrong thing to do if Rajoy wants to win reelection. Playing with Fire Tsipras is a close friend and political ally of Pablo Iglesias, the former political science lecturer who founded Spain's anti-establishment Podemos movement. Podemos is currently in the lead in Spanish polls. Elections are later this year. Rise of Extreme Parties Check out the rise of "extreme parties".

In that group there are leftwing and rightwing parties, but all have one thing in common: They are sick of something. Spain is supposedly in recovery. What are Spaniards upset about? Greeks? Spanish Unemployment  Spanish Youth Unemployment  Greek Unemployment  Greek Youth Unemployment  Unemployment is a huge problem. Growth alone will not cure this problem. Both Spain and Greece are growing now. High unemployment rates in Speece will remain for a long time unless there is debt forgiveness or Germany turns its current account surplus into a deficit for the express benefit of Speece. Speece cannot become more like Germany, unless Germany becomes less like Germany and more like Speece. Third Bailout or Grexit I believe a third bailout and a third restructuring of Greek debt is necessary (See Third Greek Bailout? Another €53.8 Billion Needed? Primary Account Surplus Revisited). Will Greece go along? Slim chance, unless "bailout" truly means bailout, not more debt. Will Germany go along? The answer is almost certainly no. That means a Grexit or a default in June when this extension ends. Can the Euro Be Saved? Pettis says "Europe must decide if this [debt forgiveness] is a cost worth paying (and I think it is)." I do not believe it's that simple (and that is not by any means simple). Here's a better way of looking at things: "Is the euro so fundamentally flawed, and tensions so high that the euro cannot possibly be saved at all?" I believe the answer to that question is yes. If it is yes, then discussion better begin soon on how to exit from this mess. If the answer is no, then someone needs to explains what it will take to get Germany to forgive enough debt to allow Speece to grow without perpetually high unemployment rates. There are only three possible paths at this point. Three Alternative Paths

There are no other realistic choices. Interestingly, none of them fixes the fundamental problem of "no enforcement mechanism" anywhere in the world. Let's turn now to the source of that particular problem. Nixon Closed the Gold Window The last semblance of enforcement mechanisms vanished when Nixon "temporarily" closed the gold window in 1971, refusing to let foreign central banks redeem their dollars for gold. What else happened at the same time? If you guessed debt soared as did income inequality, you guessed correctly. Income Inequality  The above chart from The Rise and Fall of US Income Inequality (annotations in purple added with a hat tip to zero hedge for the idea). Gross Federal Debt  Beggar Thy Neighbor Nothing is in place anywhere to stop "beggar thy neighbor", competitive currency debasement, competitive QE, negative interest rates, and all sorts of other amazing distortions brought about by central bank policies in general, not just in Europe. History suggests nothing will happen until there's a crisis. We did not use the last crisis well. Global debt went up $57 trillion dollars or so since 2007 (see Seven Years Later, Global Debt Keeps Piling Up, $57 Trillion More Than 2007) There was no deleveraging anywhere. And the leveraging up was certainly not for the benefit of the 99%. Consumer Price Deflation vs. Asset Deflation In their inane attempt to prevent consumer price deflation, the world's central banks have spawned massive asset bubbles in equities, junk bonds, and housing. When those bubbles burst, they will spawn the extremely destructive asset deflation that central bankers ought to fear, but never do because central bankers never see the bubbles they create until they burst wide open. Currency Crisis Awaits Global imbalances are so extreme, interest rate policy so absurd, and unsound fear of consumer price deflation that a massive currency crisis is all but inevitable now. The currency crisis could start in Europe. But it could also start in Japan, the UK or anywhere. Meanwhile, as long as there is no enforcement mechanism on spending and on trade imbalances, the bubbles will grow and grow and grow until central banks can no longer stuff anymore debt into the system. Good luck when the bubbles pop. Let's hope the next crisis is handled better than the last one. Don't count on it, especially when ...

Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| You are subscribed to email updates from Mish's Global Economic Trend Analysis To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment