Mish's Global Economic Trend Analysis |

- Long-Term Treasuries Rally in Face of Increasing Odds of September Hike; Taper Tantrum in Reverse?

- Greece Gets Sudden Influx of 50,000 Refugees in July (More Than 2014 Total) Seeks Help From EU

- Establishment Survey +215K Jobs, Household Employment Survey +101K, Part-Time Employment -760K, Labor Force +69K

- Taper Tantrum Coming? It Won't Be Where Nearly Everyone Is Looking! The Next Tantrum

| Long-Term Treasuries Rally in Face of Increasing Odds of September Hike; Taper Tantrum in Reverse? Posted: 07 Aug 2015 07:23 PM PDT Rate Hike Odds Increase The odds of a September rate hike rose today on the heels of a good, but not spectacular jobs report today. The Financial Times reported "After Friday's figures, traders expressed more confidence that rates would go up next month, with federal funds futures implying a 58 per cent probability of an increase after the US central bank next meets, compared with roughly 50 per cent earlier, according to Bloomberg data." On August 5, in Fed Yap vs. Futures; Bloomberg vs. CME; Eighth-Point Baby Hikes! I noted a discrepancy between CME odds (then at 0%), vs. Bloomberg odds (then at 48%). Bloomberg has it correct, see the link for an explanation. Greenspan's Measured Pace Please recall what happened when Greenspan first started hiking rates at a "measured pace". The long end of the curve blew out, as in rising rapidly. In simple terms, the bond market actually believed a recovery was underway and started rapidly pricing in hikes. The Yellen Fed has gone out of its way to say hikes will be slow and data dependent, but even still, one might reasonably expect the long-end to steepen somewhat. It hasn't. US Treasury Yield Curve Monthly Chart  US Treasury Yield Curve Daily Chart  Taper Tantrum in Reverse? It appears to me we have a taper tantrum in reverse. Simply put, the bond market is acting as if even Fed "baby step" hikes will hike the economy into recession. For further discussion, please see Taper Tantrum Coming? It Won't Be Where Nearly Everyone Is Looking! The Next Tantrum. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| Greece Gets Sudden Influx of 50,000 Refugees in July (More Than 2014 Total) Seeks Help From EU Posted: 07 Aug 2015 12:29 PM PDT The already high misery index in Greece is about to get worse. Greece already has shortages of food and supplies thanks to capital controls, and now it has to deal with a massive influx of unwanted refugees, mostly from Syria, Eritrea, and Turkey. As a result, Greece Pleads for Help From EU. Greece faces "a crisis within a crisis" as Athens struggles to cope with the sudden influx of refugees and migrants, sparking fears of a humanitarian disaster at Europe's border.Help! I can express the situation in a single word: Help! Link if video does not play: Beatles: Help! Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

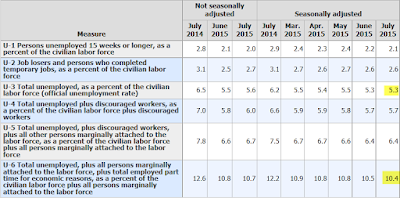

| Posted: 07 Aug 2015 10:14 AM PDT Initial Reaction Today's job report (for July) once again showed a divergence between the household survey and the establishment survey. The divergence was not as large as last month, but was in the same usual direction: The establishment survey was stronger than the household survey. Household survey employment rose by 101,000 while the establishment survey shows an increase of 215,000 jobs. Last month the household survey showed a decline in employment of 56,000 while the establishment survey shows a gain of 233,000 jobs. Part-Time Employment -760,000 One huge standout in the household data was a huge drop in part-time employment. Involuntary part-time employment declined by 180,000 while voluntary part-time employment shrank by 589,000. The decline of 180,000 in involuntary part-time employment was enough to knock the U-6 unemployment rate down by 0.1% to 10.5%. To show the volatility in this series, last month, voluntary part-time employment rose by 519,000 while part-time for economic reasons declined by 147,000. Did 760,000 people really gain full-time employment from part-time status? No chance, but there's the number. Note that last month's rise in voluntary part-time employment of 519,000 nearly matches this month's decline by 589,000. BLS Jobs Statistics at a Glance

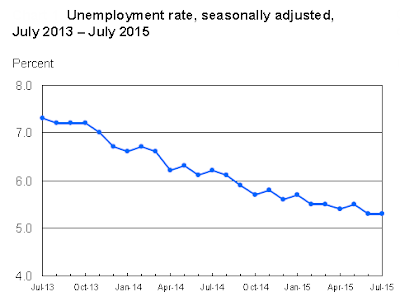

July 2015 Employment Report Please consider the Bureau of Labor Statistics (BLS) Current Employment Report. Total nonfarm payroll employment increased by 215,000 in July, and the unemployment rate was unchanged at 5.3 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in retail trade, health care, professional and technical services, and financial activities. Unemployment Rate - Seasonally Adjusted  Nonfarm Employment  Click on Any Chart in this Report to See a Sharper Image Nonfarm Employment Change from Previous Month by Job Type  Hours and Wages Average weekly hours of all private employees rose by 0.1 hours to 34.6 hours. Average weekly hours of all private service-providing employees was flat at 33.4 hours. Average hourly earnings of production and non-supervisory private workers rose $0.03 at $21.01. Average hourly earnings of production and non-supervisory private service-providing employees rose $0.05 at $20.82. For discussion of income distribution, please see What's "Really" Behind Gross Inequalities In Income Distribution? Birth Death Model Starting January 2014, I dropped the Birth/Death Model charts from this report. For those who follow the numbers, I retain this caution: Do not subtract the reported Birth-Death number from the reported headline number. That approach is statistically invalid. Should anything interesting arise in the Birth/Death numbers, I will add the charts back. Table 15 BLS Alternate Measures of Unemployment  click on chart for sharper image Table A-15 is where one can find a better approximation of what the unemployment rate really is. Notice I said "better" approximation not to be confused with "good" approximation. The official unemployment rate is 5.3%. However, if you start counting all the people who want a job but gave up, all the people with part-time jobs that want a full-time job, all the people who dropped off the unemployment rolls because their unemployment benefits ran out, etc., you get a closer picture of what the unemployment rate is. That number is in the last row labeled U-6. U-6 is much higher at 10.4%. Both numbers would be way higher still, were it not for millions dropping out of the labor force over the past few years. Some of those dropping out of the labor force retired because they wanted to retire. The rest is disability fraud, forced retirement, discouraged workers, and kids moving back home because they cannot find a job. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| Taper Tantrum Coming? It Won't Be Where Nearly Everyone Is Looking! The Next Tantrum Posted: 06 Aug 2015 11:27 PM PDT Investors have been expecting another "Taper Tantrum" when the Fed starts hiking. The term "Taper Tantrum" refers to the surge in US treasury yields (global government bond yields as well), in summer of 2013 when then-Fed Chairman Ben Bernanke put a spotlight on the wind down of Fed asset purchases (tapering off QE). In February of 2014, the Wall Street Journal stated Last Year's Taper Tantrum May Have Been Taste of the Future. The Journal cited a research paper on Market Tantrums and Monetary Policy. Stimulus No Free Lunch "When investors infer that monetary policy will tighten, the instability seen in summer of 2013 is likely to reappear," warns the report. "Stimulus now is not a free lunch, and it comes with a potential for macroeconomic disruptions when the policy is lifted," the paper said. The paper's authors are J.P. Morgan Chase economist Michael Feroli, University of Chicago professor Anil Kashyap, New York University's Kermit Schoenholtz and Hyun Song Shin of Princeton University. Hell of a Payback, But When? I certainly agree that stimulus is no free lunch and there is going to be one hell of a payback for all this stimulus, but when and where? 2015 Repeat? On May 14, 2015, MarketWatch asked Is This a Repeat of the 2013 Taper Tantrum? Let's take a look at a couple charts from the article. Pace in Rate Rise  That may appear ominous, but who's to say 2015 follows 2013? Here is a chart of 10-year treasuries yields as of today. US Treasury 10-Year Yield  The latest rise looks hugely unconvincing to me. Indeed, there was a far steeper rise in 2012 than the MarketWatch article fails to show! Let's take a look at the second MarketWatch chart. Taper Talk 2013  That's interesting, but once again we need to hone in on current action. Here's an up-to-date chart I just produced with data from Fred (Federal Reserve Economic Data). US 10-Year Yield and Breakeven Inflation Rate  There is absolutely no hint of a taper tantrum recently. Instead, yields have been falling smack in the face of fed hikes, now purportedly coming in September. Note the breakeven inflation rate is heading South, even as the Fed is prepared to hike. I can spell what that means in one word: recession. Fed Yap vs. Futures; Bloomberg vs. CME; Eighth-Point Baby Hikes! Friday's Job report may skew the odds, but this is how I see things: Fed Yap vs. Futures; Bloomberg vs. CME; Eighth-Point Baby Hikes! Fed's "Mother May I" ToolMarket May I The only change I would make, regardless of the jobs report, would be to call it "Market May I" take a baby step. A Real Tantrum! People forget what a "real tantrum" looks like. I happen to have a chart that depicts one. Junk Bond Tantrum 2007-Present  click on chart for sharper image Now, that's one hell of a tantrum. The tantrum was not in US treasuries, but rather in junk bonds. The above chart shows yield on junk bonds as well as the spread between yields on junk bonds vs. similar duration US treasuries. I did not mark the peak on purpose. Instead I marked a secondary high. Look at the date closely. The S&P 500 bottomed at 666 on March 9, 2009, precisely the date of the final surge in junk bond yields. Fancy that. What else was in play? Mark-to-Market Accounting Please check out the history of Mark-to-Market Accounting.

Mark-to-Fantasy Dateline vs. S&P 500  The final stock market plunge from January-March 2009 occurred when the FASB "decided not to suspend mark-to-market accounting". The recovery began just before mark-to-fantasy resumed. I believe the two are related. Viable corporations could not get funding. They were priced as if they might go bankrupt. The problem was not (and still is not) mark-to-market accounting. Leverage is the problem. Let's hone in on subsequent details. Junk Bond and Spreads 2011-Present  Interestingly, the current focus is on the relatively minor "taper tantrum" in 2013, not the enormous junk bond revolt in 2008 or the followup revolt in October of 2011. Note the "orderly so far" rise in junk bond yields. Enormous Corporate Bond Bubble Banks were (and still are) leveraged to the hilt. And that remains a problem. In addition, the corporate bond bubble is enormous. Bernanke and the FASB revived the junk bond market in 2009 with mark-to-fantasy, a flood of QE, and zero percent interest rates. In the ensuing years, corporations borrowed heavily, not to invest, but rather to buy back their own shares at absurd prices. And people expect no payback! The Next Tantrum Problems will resurface as interest rates rise, and especially when the junk bond market starts worrying about ability of corporations to pay back speculative loans, not at falling interest rates, but at rising rates, even if only baby-step hikes. Investors eying treasuries for signs of a tantrum are likely looking in the wrong place. Junk is where the action is. Finally, treasuries may easily be the beneficiary of the next tantrum, just as they were in 2007, in stark contrast to what most "tantrum watchers" expect. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| You are subscribed to email updates from Mish's Global Economic Trend Analysis To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment