| About That Illinois Pension "Fix" Posted: 10 Dec 2013 09:30 PM PST The highly touted Illinois plan to fix its pension system is largely hot air. I was waiting for details to prove just that and they came out today. Let's flashback to the initial claim. A headline from six days ago reads Illinois lawmakers approve fix for $100b pension crisisThe Illinois Legislature approved a historic plan Tuesday to eliminate the state's $100 billion pension shortfall, a vote that proponents described as critical to repairing the state's deeply troubled finances but that faces the immediate threat of a legal challenge from labor unions.

The measure approved Tuesday emerged last week following negotiations by a bipartisan pension conference committee and then meetings of Illinois' legislative leaders. They say it will save the state $160 billion over 30 years and fully fund the systems by 2044.

It would push back the retirement age for workers ages 45 and younger, on a sliding scale. The annual 3 percent cost-of-living increases for retirees would be replaced with a system that only provides the increases on a portion of benefits, based on how many years a beneficiary was in their job. Some workers would have the option of freezing their pension and starting a 401(k)-style defined contribution plan.

Workers will contribute 1 percent less to their own retirement under the plan. Legislative leaders say they included that provision, as well as language that says the retirement systems may sue the state if it does not make its annual payments, in hopes of boosting the measure's odds of surviving the unions' anticipated court challenge. Actuarially Unsound Unions are opposed to the plan, as always, and will file lawsuits, as always. But the plan does not even work. Via email, Jonathan Ingram, at the Illinois Policy Institute explains... House Speaker Mike Madigan and proponents of the temporary pension "fix" enacted last week promised taxpayers that it would immediately reduce the state's unfunded pension liability by about $20 billion. But despite these promises, the credit rating agencies have indicated that they would be waiting for actuarial analyses before making any decisions on how the new law will affect Illinois' worst-in-the-nation credit rating.

They're wise to wait. It turns out that somewhere between $6 billion and $8 billion of Madigan's promised reduction is solely the result of accounting gimmicks.

Part of the "fix" Madigan's bill offers is to eventually move to what's called the "Entry Age Normal" cost method for calculating how much the state should be contributing to pensions each year. That's actually a good idea. This new accounting method helps make the pension ramp a little less steep. It's also required by the new pension accounting rules promulgated by the Governmental Accounting Standards Board.

But here's the problem: switching to this new accounting method actually increases the state's unfunded liability by approximately $6 billion to $8 billion in the short term, because it attempts to spread the costs over the course of employees' careers, rather than having them backloaded like we do now.

So how do you make up for that increase when you're trying to reduce the state's unfunded liability? Do you incorporate more comprehensive reforms to get that debt under control? Not if you're Madigan.

Instead of addressing that increase, the pension bill simply delays implementing the accounting change until fiscal year 2016. This means that the state gets to pretend that at least $6 billion to $8 billion of the pension debt simply doesn't exist for now. But when the new rules take effect in 2016, that pension debt is added back to the books. Instead of cutting $20 billion off the unfunded liability as promised, it looks like Madigan's bill only really cuts $12 billion to $14 billion.

Actuaries for the state's largest pension system recommended against delaying the new accounting rules. As they noted, the gimmick is being used to "maximize the amount of liability reduction," even though 25% to 35% of that liability reduction will be added back to the pension debt in just a few years.

The rating agencies have already begun cracking down on state and local governments for using gimmicks to paper over their true pension debt.

Are lawmakers seriously hoping they'll overlook this one, especially when our own actuaries are highlighting it? Pension Fight Could Create Deeper HoleThe Washington Post reports Ill. pension fight could create deeper fiscal holeWith the fight over solving Illinois' worst-in-the-nation pension shortfall now headed to the courts, the financially troubled state faces a grim possibility: The plan could be tossed, and Illinois could wind up in an even deeper fiscal hole than the one it's in now.

Legislative leaders, anticipating a legal challenge from public-employee unions once the landmark bill approved Tuesday is signed, went extra lengths to bolster the law's odds in the courtroom — including an unusual three-page preamble to the legislation in which they lay out their case for cutting worker and retiree benefits.

But legal experts say those efforts could mean little in a state that provides some of the country's stronger constitutional protections of pension benefits.

They point to Arizona as a possible warning sign. In 2012, a judge there said a law raising the employee contribution to pension benefits was illegal, and ordered the state to repay the money to workers — with interest.

Illinois, Michigan and Arizona are among the seven states that have clauses in their state constitutions that protect pension benefits, according to the Center for Retirement Research at Boston College. The others are Alaska, Hawaii, Louisiana and New York.

Illinois and New York's protections are considered to the strongest, however, because the language expressly states that it applies to current and future benefits.

A coalition of labor unions known as We Are One Illinois stated immediately after the bill passed that it will sue if Gov. Pat Quinn signs it, which the Chicago Democrat is expected to do as early as this week.

Quinn said he believes the legislation is constitutional and will ultimately be upheld by the Illinois Supreme Court.

"It is necessary for the economic good for the people of our state, and I think the court will see it that way," he said. Economic Good of the StateIf Governor Quinn really wants to do something for the "economic good of the state" he can start by signing legislation that would ... - End collective bargaining rights for Illinois public unions.

- Make Illinois a right-to-work state.

- Scrap prevailing wage laws.

- End defined benefit pension plans going forward.

- Lower taxes for the average citizen.

- Hike taxes on public union pension payments enough to make the system sound.

Plan Worth Fighting ForAs long as there is going to be a court battle with the unions, you may as well go to court over a plan that will actually fix the system. Illinois should figure pension liabilities at a reasonable rate of return, say the 30-year treasury rate. That would make the plan underfunding look far worse today, but so be it. The idea is sound. Then after barring new entrants into the scheme, the state should hike taxes on pension recipients enough to make the system fully funded with no additional taxes on regular taxpayers. I propose something along the lines of "taxing pension benefits above a specified amount at 80%, taken straight out of the check". The "specified amount" would be determined based on what it takes to make the system actuarially sound in a reasonable timeframe (say 15 years). If you going to have a fight, make it a fight worthwhile. As always, it's best to have a plan B. I propose a simple one: default on pension obligations above a certain level, but pay all other state obligations early to avoid bond market disruptions.

Public Unions Should Bear the Brunt of the PainPublic unions (in conjunctions with pandering politicians) wrecked Detroit, and numerous cities in California and other states. Together they wrecked Illinois. It's perfectly fair for unions to bear the brunt of the pain in working out a solution. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| French Industrial Output Drops Unexpectedly; France Finance Minister in Complete Denial; Expect the Unexpected Posted: 10 Dec 2013 11:39 AM PST I am in a near-constant state of amusement regarding what economists and analysts expect vs. what happens. A perfect example came up today. MarketWatch reports French Industrial Output Drops Unexpectedly. French industrial output dropped unexpectedly in October for the second month in a row, data from national statistics bureau Insee showed Tuesday, providing a further indication of a weak start to the final quarter of 2013 in the euro zone.

Industrial production in the currency bloc's second largest economy fell 0.3% in October from September, when it also fell 0.3%, Insee said. Analysts polled by Dow Jones Newswires had expected a 0.2% rise in October.

The October decline confirms a steady shrinking of output in industry. Over the three months through October, industrial production was 0.6% below the previous three months, Insee said.

The disappointment comes after separate data showed Monday that German industrial production dropped 1.2% in October from the previous month. Why Was This Unexpected?This decline should have been completely expected. I can give you three reasons. - On December 2, the Markit France Manufacturing PMI final data showed "France PMI sinks to five month low as output and new orders fall at sharper rates".

- On December 4, the Markit France Services PMI final data showed "French service sector slips back into contraction in November".

- On December 4, the Markit Eurozone Composite PMI final data showed "Eurozone growth slows further as France and Italy suffer renewed contractions".

If you are looking for a 4th bonus reason, please pencil in "Francois Hollande" and all the socialist ministers in his government. From the third Markit link above ... Sector Output Growth ( Nov. )

Germany 55.4 29-month high

Ireland 55.4 5-month low

Spain 50.8 3-month high

Italy 48.8 5-month low

France 48.0 5-month low

Eurozone employment fell again in November, extending the current unbroken sequence of decline to 23 months. France, Italy and Spain all reported job losses during the latest survey month. Chris Williamson, Chief Economist at Markit said: " declines in the PMIs for Italy and France raise the prospect of these countries' economies contracting again in the fourth quarter, meaning Italy's recession will have extended into a staggering tenth successive quarter and France will have slid back into a new recession." Amusingly, analysts polled by Dow Jones Newswires had expected a 0.2% rise in industrial production. France Finance Minister in Complete DenialThose of you seeking still more amusement can find it in one of the usual places: statements made by French politicians. For example (and also from today), the Financial Times reports Pierre Moscovici, France Finance Minister Says Economy has 'Truly Emerged from Recession'"France has truly emerged from recession," Moscovici insists. "Of course, I would like to see the growth rate increase, but I wish we could stop this attitude of systematic doubt about the French economy."

This week the Bank of France upped its forecast for fourth-quarter growth to 0.5 per cent. The big international economic institutions, including the European Commission, broadly agree with the government's forecasts of about 1 per cent growth next year, followed by 1.7 per cent in 2015.

"It's not wishful thinking. I base what I am saying on reality," says Mr Moscovici.

[In regards to EU deficit limit of 3 per cent of GDP, the target pushed back to back to 2015] ... That will be met, Mr Moscovici assures. "I'm not just confident, I'm committed. We are on course to hit the target and there is no reason to doubt that."

From 2015, 100 per cent of the deficit reduction effort will come from public spending cuts, he says. But he offers no apologies for the government's initial reliance on tax increases, despite the recent protests. Anyone Believe Moscovici? Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| Close Inspection of Alleged "Draconian" Cuts in Food Stamp Program; Mish SNAP Proposal Posted: 10 Dec 2013 09:23 AM PST Inquiring minds are digging into the alleged "Draconian Cuts" in Food Stamps as championed by the Daily Koz. Of course the Daily Koz is not alone in whining about "draconian" cuts. Note: The food stamp program is now called "SNAP" Supplemental Nutrition Assistance Program. "The Unthinkable"On December 5, Greg Kaufmann, writer for The Nation wondered Why Is a Senate Democrat Agreeing to Another $8 Billion in Food Stamp Cuts? On the same day that President Obama eloquently described his vision of an economy defined by economic mobility and opportunity for all, Senate Agriculture Committee Chairwoman Debbie Stabenow was busy cutting a deal with House Agriculture Committee Chairman Frank Lucas to slice another $8 to $9 billion from food stamps (SNAP), according to a source close to the negotiations.

"That was the first time in history that a Democratic-controlled Senate had even proposed cutting the SNAP program," said Joel Berg, executive director of the New York City Coalition Against Hunger. "The willingness of some Senate Democrats to double new cuts to the program…is unthinkable." Mother Jones Says "Kill the Farm Bill Entirely"Bitching and moaning would not be complete without Mother Jones getting in on the act. On November 12, Mother Jones proposed House Dems Can Block GOP Food Stamp Cuts—by Killing the Farm BillThe food stamps program—which helps feed 1 in 7 Americans—is in peril. Republicans in the House have proposed a farm bill—the five-year bill that funds agriculture and nutrition programs—that would slash food stamps by $40 billion. But by taking advantage of House Republicans' desire to cut food stamps as much as possible, Democrats might be able to prevent cuts from happening at all.

To pull it off, Democrats would have to derail the farm bill entirely, which would maintain food stamp funding at current levels. Where's the Beef?On December 10, The Tennessean more evenly covers the issue in its report TN House Republicans back $40 billion in food stamp cuts. The future of food stamps — the Supplemental Nutrition Assistance Program — remains the largest sticking point in House-Senate negotiations to finalize a new farm bill before the end of the year.

In September, the House approved a farm bill that cuts almost $40 billion from food stamps over 10 years — about 5 percent a year. The Senate earlier approved a bill that would cut $4 billion over that time.

At $80 billion a year, food stamps remain the single costliest item in the farm bill. The program serves almost 48 million Americans and 1.34 million Tennesseans — about 20 percent of the state population.

Among House members from Tennessee, all but Reps. Jim Cooper of Nashville and Steve Cohen of Memphis — the two Democrats in the state's congressional delegation — voted for the bill making $40 billion in cuts.

Groups such as the Center on Budget and Policy Priorities, a liberal-leaning Washington think tank, say cuts of that magnitude would result in denying benefits to 3.8 million low-income Americans in 2014.

"Those who would be thrown off the program include some of the nation's most destitute adults, as well as many low-income children, seniors and families that work for low wages," the CBPP said in an analysis of the House bill. "The House SNAP bill is harsh."

Rep. John Duncan, R-Knoxville, complained that administrators of the program "have no incentive to keep people off."

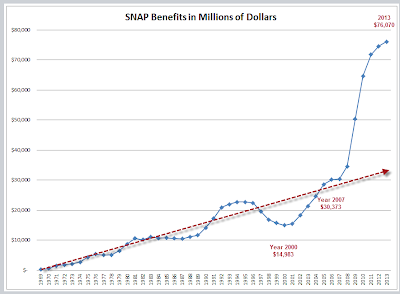

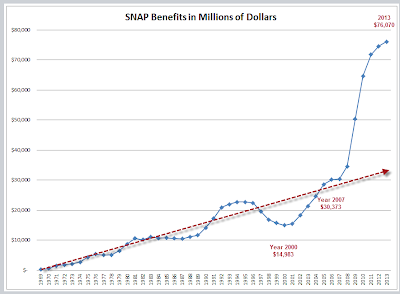

"They will get bigger offices, staffs and funding if even more people get food stamps," he said. Close Inspection of "Draconian" CutsPlease note that the alleged $40 billion in cuts is really only $4 billion in a close to $80 billion program. They arrive at $40 billion by multiplying $4 billion by 10 years. OK Fine. The cuts then are $40 billion in an $800 billion program. And I actually doubt we will ever see those "cuts" in the first place. A few charts from reader Tim Wallace will help explain. SNAP Growth in Benefits click on any chart for sharper imageSNAP Benefit Facts click on any chart for sharper imageSNAP Benefit Facts- SNAP benefits more than doubled between 2000 and 2007.

- Between 2007 and 2013 snap benefits went up another 150%.

- Trendline growth would have annual benefits at about $32.5 billion.

- Instead benefits are more than double.

- Liberals are whining about a 5% cut when a cut to the trendline would be a 50% cut

SNAP Participation SNAP Participation Facts SNAP Participation Facts- Participation is nearly double what it was in 2007.

- Participation in 2013 is 275% of the 2001 total.

SNAP Per Person Benefits SNAP Per Person Benefits Facts SNAP Per Person Benefits Facts- Monthly benefit goes up over time because of inflation.

- Benefits per person jumped in 2007.

- Monthly per person benefit is now $133.

- Trendline benefit is $117.

Supposedly a 5% cut is draconian. The Problem- Growth in the number of participants is on an unsustainable trend.

- Growth in benefits per person is also on an unsustainable trend.

- Multiply the two together and you get the first chart.

As is typical with government programs, there is no incentive by the administrators to eliminate waste or fraud. The more funding for food stamps, the bigger the salaries and staffs of the administrators. I suggest that we need a way to provide necessary safety-net benefits while simultaneously providing an incentive to get off the program and get a job. I repeat my proposal. Mish SNAP Proposal- Prohibit food stamp purchases of potato chips, snacks, soft drinks, candy, pizza, frozen foods of any kind except juice.

- Limit food stamp users to generic (store brand vs. name brand) dried beans, rice, peanut butter, pasta, fresh vegetables, fresh fruit, frozen (not bottled) juice, canned vegetables, canned soup, soda crackers, poultry, ground beef, bread, cheese, powdered milk, eggs, margarine, and general baking goods (flour, sugar, spices).

- Calculate a healthy diet based on current prices, number in the family, ages of recipients, and base food stamps allotments on that diet.

- In the interest of health and cleanliness, expand the food stamp program to include generic soap and laundry products.

My proposal will not only lower the cost of the food stamp program, the resultant healthier diets would lower Medicaid and Medicare costs as well. Moreover, my proposal would give people a strong incentive to get off the food stamp program without intrusive, costly big-brother ideas like drug testing which cannot possibly work for the simple reason that anyone who fails will steal to get food rather than starve. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

No comments:

Post a Comment